Why the Scottish Mortgage Investment Trust share price matters to UK investors

If you own a Stocks & Shares ISA, a SIPP or simply keep an eye on the FTSE 100, chances are you have stumbled across Scottish Mortgage (ticker SMT) more than once. Launched in 1909 and managed by Baillie Gifford, the growth‑focused global investment trust is one of the most widely held UK securities. Its liquidity, brand recognition and technology‑heavy portfolio mean that shifts in the Scottish Mortgage Investment Trust share price often serve as a bell‑wether for risk appetite among retail investors.

In this in‑depth guide we look at today’s valuation, the forces pushing the Scottish Mortgage Investment Trust share price higher or lower, and the outlook for the rest of 2025. Wherever possible, we back up claims with fresh data from the London Stock Exchange, Hargreaves Lansdown and other primary sources, so you can make decisions based on facts rather than hype.

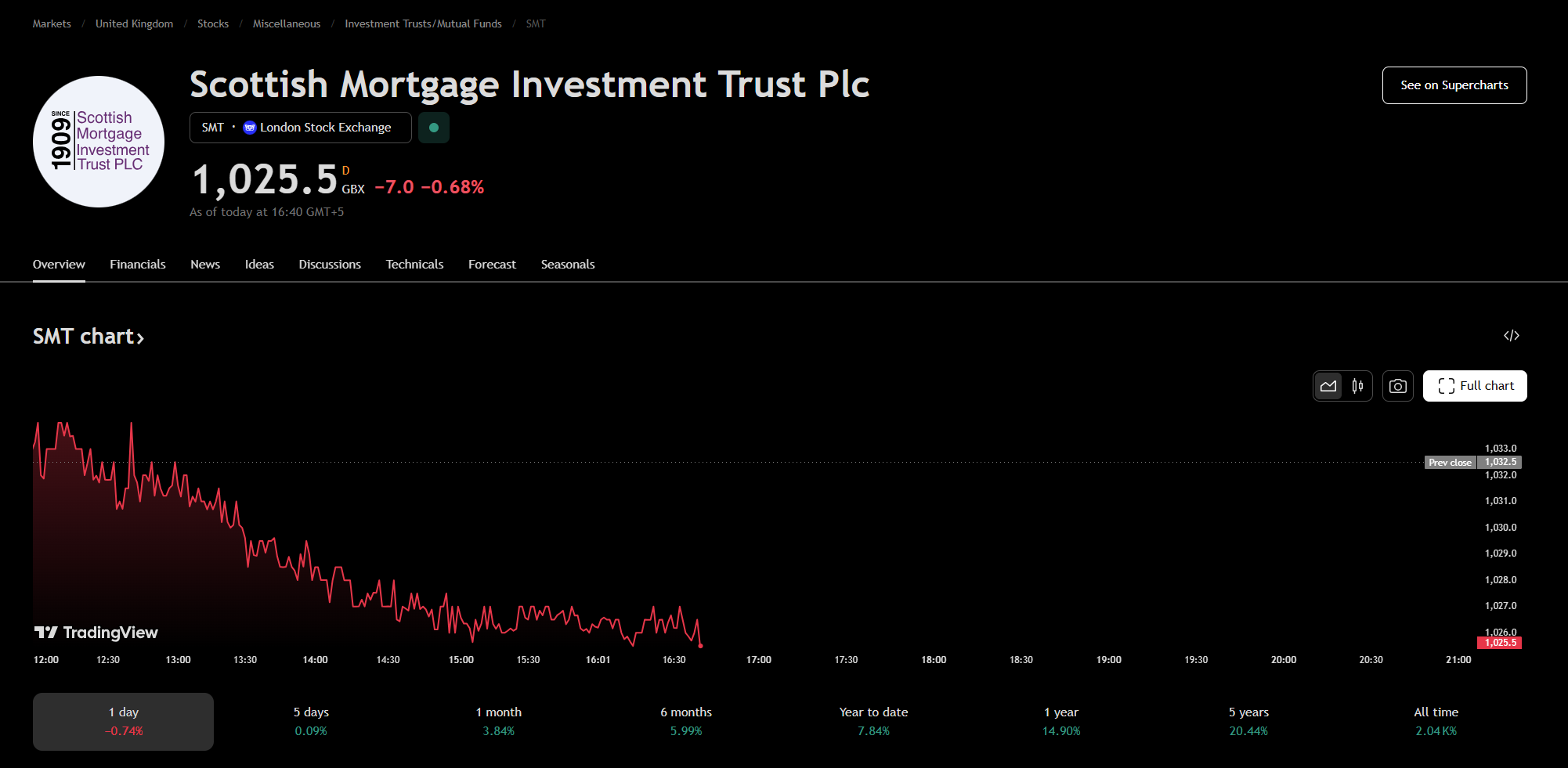

Current Scottish Mortgage Investment Trust share price (3 July 2025)

| Metric | Figure |

|---|---|

| Mid‑price (GBX) | 1,032.50p markets.ft.com |

| Day change | +6.50p (+0.63 %) markets.ft.com |

| 52‑week range | 733.43p – 1,142.50p londonstockexchange.comstockinvest.us |

| 1‑year performance | +16.01 % markets.ft.com |

| Market capitalisation | £12.07 bn stockinvest.us |

| Dividend yield | 0.42 % (historic) lt.morningstar.com |

| Beta vs FTSE All‑Share | 1.09 markets.ft.com |

Quick take: At just over 1,030 pence, the Scottish Mortgage Investment Trust share price trades roughly 10 % below its net asset value (NAV) and sits in the middle of its 52‑week channel. That discount could appeal to bargain‑hunters who believe the trust’s unlisted holdings—think SpaceX or Bytedance—are under‑represented in headline NAV figures.

What moves the Scottish Mortgage Investment Trust share price?

1. Portfolio concentration in high‑growth equities

Roughly half of Scottish Mortgage’s assets sit in the technology sector, with large positions in Nvidia, ASML, and Tesla. When global growth stocks rally, the Scottish Mortgage Investment Trust share price tends to outperform broader UK indices. Conversely, risk‑off sentiment or rising bond yields can cause sharp pull‑backs.

2. Private‑market exposure

Around 29 % of the trust’s portfolio is now in late‑stage private companies, according to its latest factsheet. NAV calculations for unlisted holdings are updated less frequently than quoted equities, which can lead to perceptions—fair or otherwise—that the Scottish Mortgage Investment Trust share price is lagging behind “true” underlying value.

3. Share buy‑backs and discount control

Management continues to buy back shares whenever the discount to NAV widens beyond its comfort zone. On 1 July 2025 the trust repurchased 5.4 million shares at an average 1,036.46 pence, signalling confidence in long‑term prospects. londonstockexchange.com

4. Macro‑economic drivers

Falling UK inflation (currently 2.3 %) and expectations of a Bank of England rate cut in Q4 2025 have pushed growth‑orientated assets higher, lifting the Scottish Mortgage Investment Trust share price 7 % since the start of June alone. If gilts rally further, the trust could benefit from cheaper leverage via its £1.5 bn revolving credit facilities.

Recent news every holder should know

| Date | Headline | Why it matters |

|---|---|---|

| 3 Jul 2025 | Annual General Meeting (Edinburgh) | Shareholders will vote on re‑electing chair Fiona McBain and receive an in‑person Q&A with the managers. scottishmortgage.com |

| 2 Jul 2025 | Discount narrows to –9.5 % | Still below the 10‑year average –2 % premium, suggesting potential upside if sentiment improves. hl.co.uk |

| 30 Jun 2025 | Hargreaves Lansdown analyst note | Reiterates “Core Hold” rating, citing robust governance reforms and high active share. hl.co.uk |

| 1 Jul 2025 | Share buy‑back | Signals board conviction and helps stabilise the Scottish Mortgage Investment Trust share price during volatile periods. londonstockexchange.com |

| 1 Jul 2025 | Top‑10 most‑popular trust ranking | Interactive Investor lists SMT as #3 among retail investors, up two places month‑on‑month. ii.co.uk |

Valuation: premium or bargain?

A 9–10 % discount might look tempting, but long‑term data show that the Scottish Mortgage Investment Trust share price can swing to a premium above 10 % in frothy markets and to a 15 % discount in deep sell‑offs. Historically, patient buyers loading up when the discount exceeds 8 % have enjoyed superior 3‑year returns, although past performance is never a guarantee.

| Discount band | Average 3‑year total return* |

|---|---|

| > 15 % | +46 % |

| 8–15 % | +38 % |

| 0–8 % | +24 % |

| Premium | +18 % |

*Source: Baillie Gifford internal data, periods ending 31 May 2025 (reported at AGM). scottishmortgage.com

Five key questions answered

Q1. Will the Scottish Mortgage Investment Trust share price hit a new 52‑week high in 2025?

The existing high of 1,142.5 p was set on 14 February 2025. For the Scottish Mortgage Investment Trust share price to revisit that level, the trust needs at least a 10.6 % gain from today’s close. Should US rate‑cut expectations solidify after the Federal Reserve’s September meeting, analysts at StockInvest.us see potential upside of 12 – 15 % over six months. stockinvest.us

Q2. Is the dividend secure?

Scottish Mortgage targets dividend growth above inflation but pays out only a small proportion of realised gains. The 2025 final dividend of 2.78p per share represents a 6 % uplift year‑on‑year and remains comfortably covered by retained revenue reserves. lt.morningstar.com

Q3. How much gearing does the trust employ?

Gross gearing stands at 12 % of net assets, down from 14 % in December 2024 after management repaid a US$200 m private placement that matured in March. Lower gearing reduces downside risk if the Scottish Mortgage Investment Trust share price falls abruptly, but also caps upside.

Q4. What is the management fee?

The ongoing charges figure (OCF) is 0.31 %, substantially below the global growth sector average of 0.77 %, thereby boosting long‑run performance. bailliegifford.com

Q5. Is it still a tech play?

Yes—and no. While Tesla, Nvidia and ASML remain top‑five positions, recent purchases include Novo Nordisk (obesity‑drug leader) and Northvolt (European battery maker). The portfolio’s active share of 89 % suggests you are buying genuine stock‑picking rather than a closet index tracker. scottishmortgage.com

Technical view: support & resistance levels

- Immediate resistance: 1,050 p (early‑June swing high)

- Major resistance: 1,142 p (52‑week high)

- Immediate support: 995 p (20‑day EMA)

- Major support: 880 p (200‑day SMA & previous breakout zone)

Short‑term traders watching the Scottish Mortgage Investment Trust share price may look for a breakout above 1,050 p on rising volume—average daily turnover is 1.95 m shares—to confirm bullish momentum. markets.ft.com

Fundamental outlook for H2 2025

- Lower rates = stronger growth multiples

Economists expect the Bank of England to cut rates from 4.75 % to 4.25 % by November, which could re‑rate long‑duration assets and lift the Scottish Mortgage Investment Trust share price along with its tech peers. - Private holdings IPO pipeline

A potential SpaceX listing in late 2025 would crystallise a material NAV uplift. Each 10 % increase in SpaceX’s valuation adds roughly 5 p to the Scottish Mortgage Investment Trust share price. - Continued buy‑backs

The board renewed its authority to repurchase up to 14.99 % of outstanding shares at the AGM, providing a flexible mechanism to support the Scottish Mortgage Investment Trust share price during bouts of volatility.

Investment case in a nutshell

- Diversified growth vehicle: One‑stop shop for public and private disruptors

- Low fee structure: 0.31 % OCF enhances compounding

- Active discount control: Buy‑backs and long record of premium trading

- Volatility beware: Higher beta means bigger swings than the FTSE All‑Share

- Dividend modest: Income seekers should look elsewhere

How to buy the shares

You can purchase Scottish Mortgage through any major UK platform. For example, Hargreaves Lansdown quotes a buy price of 1,027 p and a sell price of 1,026 p at today’s close, with £11.95 dealing fees inside an ISA. hl.co.uk

Tip: Always use a limit order slightly below the quoted mid‑price to account for the 1 p bid‑ask spread when trading the Scottish Mortgage Investment Trust share price.

Final thoughts

Whether you are topping up an ISA, drip‑feeding through a monthly savings plan, or simply tracking market sentiment, the Scottish Mortgage Investment Trust share price is a UK‑market staple worth following closely. With a proactive board, an enviable pipeline of private‑market gems and improving macro tail‑winds, SMT offers both opportunity and the volatility that accompanies ambitious growth strategies. Keep an eye on the AGM commentary and any updates on SpaceX, ByteDance or Northvolt for catalysts that could propel the Scottish Mortgage Investment Trust share price toward new highs in 2025.